Bitcoin's Path to $73k: Key Price Levels to Monitor

Explore Bitcoin's potential drop to $73k and key price levels to monitor during this bear market phase, ensuring you're prepared for market shifts.

Bitcoin has been steadily descending the liquidity staircase, with a significant milestone projected at $85,000.

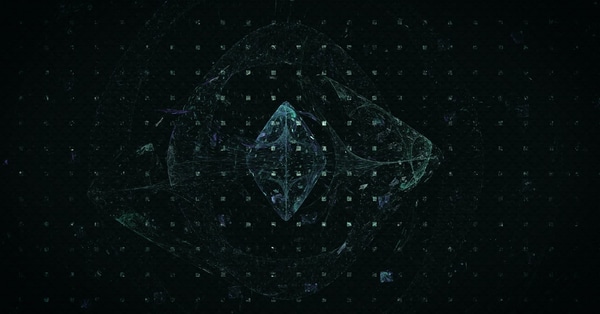

This figure is derived not from traditional methods like Fibonacci retracement or moving average crossovers, but rather from a simple grid of horizontal bands that incorporate elements that actually influence market behavior: order-book depth, leverage positioning, psychological price points, and historical price movements spanning an 18-month timeframe.

In essence, these price levels represent where traders typically set their stop-loss and take-profit orders.

When examining a 30-minute chart, these bands create substantial channels, and throughout the past year, Bitcoin has interacted with these price levels repeatedly, pausing, stalling, and reversing at these consistent points.

However, the trend has shifted downward over the past month.

The uppermost white band marks the all-time high for Bitcoin at $126,000, where it traded from May through October, experiencing minor dips in September. The moment it fell below during the tariff crash on October 11, it ultimately broke free from that zone at the beginning of this month.

At the onset of this downward trend, Bitcoin briefly dipped to a crucial price level of $106,400, a point I’ve elaborated on extensively in previous discussions. Historically, such wicks on the 30-minute chart serve as foreboding indicators that the price will eventually revisit that level. This instance has proven to be no exception.

As the price trajectory evolved, trading activity began to cluster around the upper region of the narrow yellow band, roughly between $112,000 and $106,400. Any effort to ascend into the subsequent white lines faced significant resistance, with the channel acting as a barrier that absorbed buying pressure.

This persistent struggle to break free has led to a series of lower highs, signifying a bearish trend. The market sentiment has shifted, and traders are now navigating a landscape that appears to be increasingly resistant to upward movement.

As the market continues to evolve, keeping an eye on these key price levels is crucial for anyone looking to navigate Bitcoin's bear market effectively. The psychological barriers created by previous highs and trading patterns can offer valuable insights into future movements.

In conclusion, while Bitcoin's path may seem unclear, understanding the underlying factors driving market behavior can provide clarity. As we move forward, being prepared for potential price fluctuations and knowing where to set your stop-loss and take-profit orders will be essential for traders aiming to capitalize on the opportunities within this bear market.

Tags:

Related Posts

Your Friendly Guide to Choosing a Secure Hardware Wallet

Feeling overwhelmed by hardware wallet choices? Let’s simplify it! Discover how to safeguard your crypto assets with the right storage solution.

Bouncing Back: 5 Steps to Recover from Crypto Losses

Lost money in crypto? You're not alone! Discover five practical steps to help you bounce back and regain your investing confidence.

How to Explain Cryptocurrency at Family Dinner

Not sure how to tackle the cryptocurrency convo with your family? This guide breaks it down in a way everyone can understand—without the jargon!

Exploring NFT Real Estate: A New Investment Frontier

Curious about how NFTs are changing real estate? Discover the potential of digital property investments and what it means for the future of ownership.

Start Earning Passive Income with Ethereum Staking

Learn how to make your Ethereum work for you! Discover the steps to start staking and turn your crypto into a reliable source of passive income.

Top 5 Yield Farming Platforms in 2023: My Personal Picks

Curious about yield farming? Join me as I break down the top 5 DeFi platforms for 2023—let’s find the best options together!