Dogecoin Faces Pressure as Long-Term Holders Liquidate Assets

Dogecoin's price struggles as long-term holders sell off assets, raising concerns about support levels.

As we move into November, Dogecoin's recent price rebound is showing signs of weakness, with a mere 1.2% increase. Currently, DOGE is down 5.9% over the last week and has plunged nearly 27% this month. Alarmingly, on-chain indicators reveal a growing trend of selling.

The pressing question now is whether Dogecoin's support level at $0.17—maintained since October 11, even amidst bearish fluctuations—can withstand the selling pressure from long-term holders.

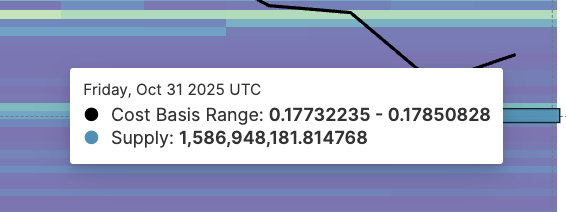

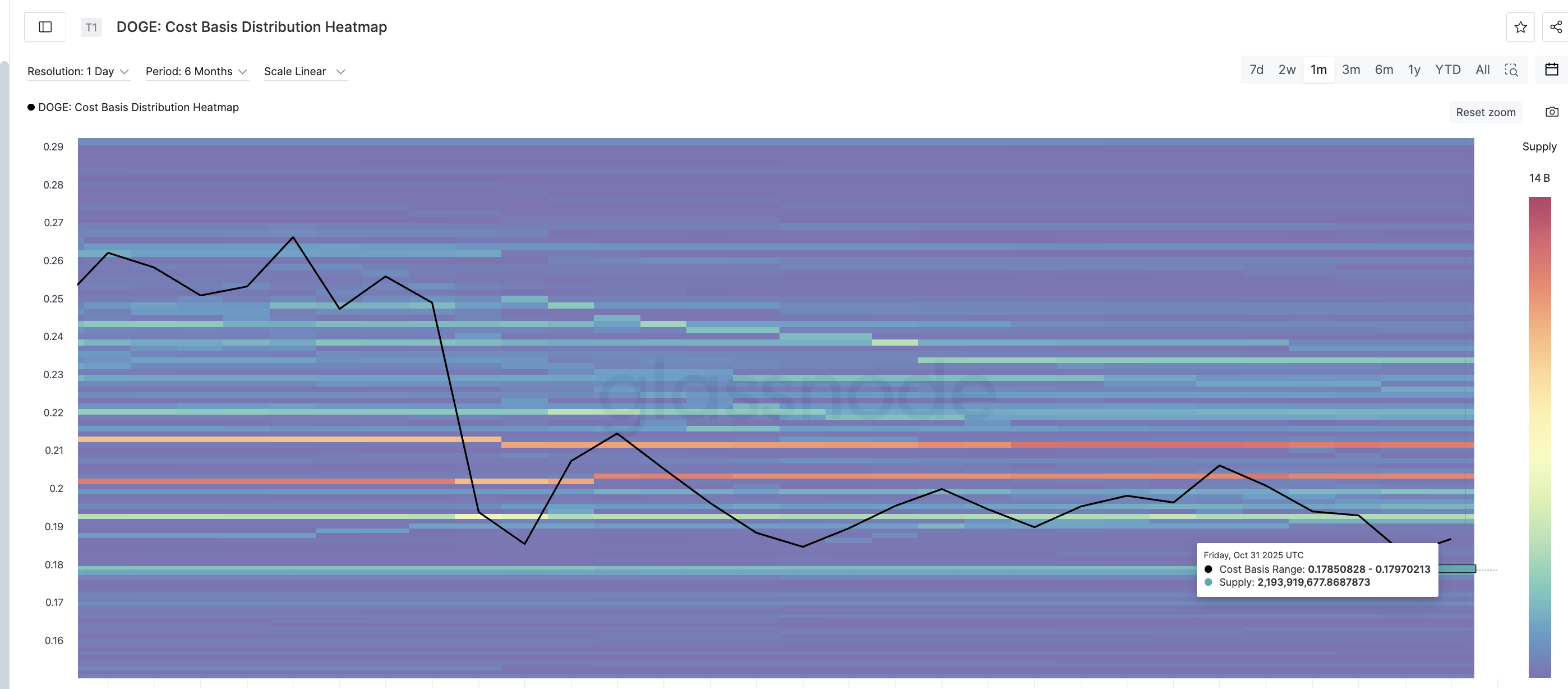

Cost Basis Heatmap: The Critical Support Zone

Recent on-chain cost basis data pinpoints Dogecoin's primary short-term support between $0.177 and $0.179, where approximately 3.78 billion DOGE were accumulated in the past.

This price range marks where the bulk of long-term holders have their holdings, serving as a significant buffer during previous sell-offs.

If you're looking for more insights into tokens like this, subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

The cost basis heatmap illustrates where the majority of investors last acquired their tokens, highlighting price ranges with dense concentrations of long-term holders that function as support or resistance levels.

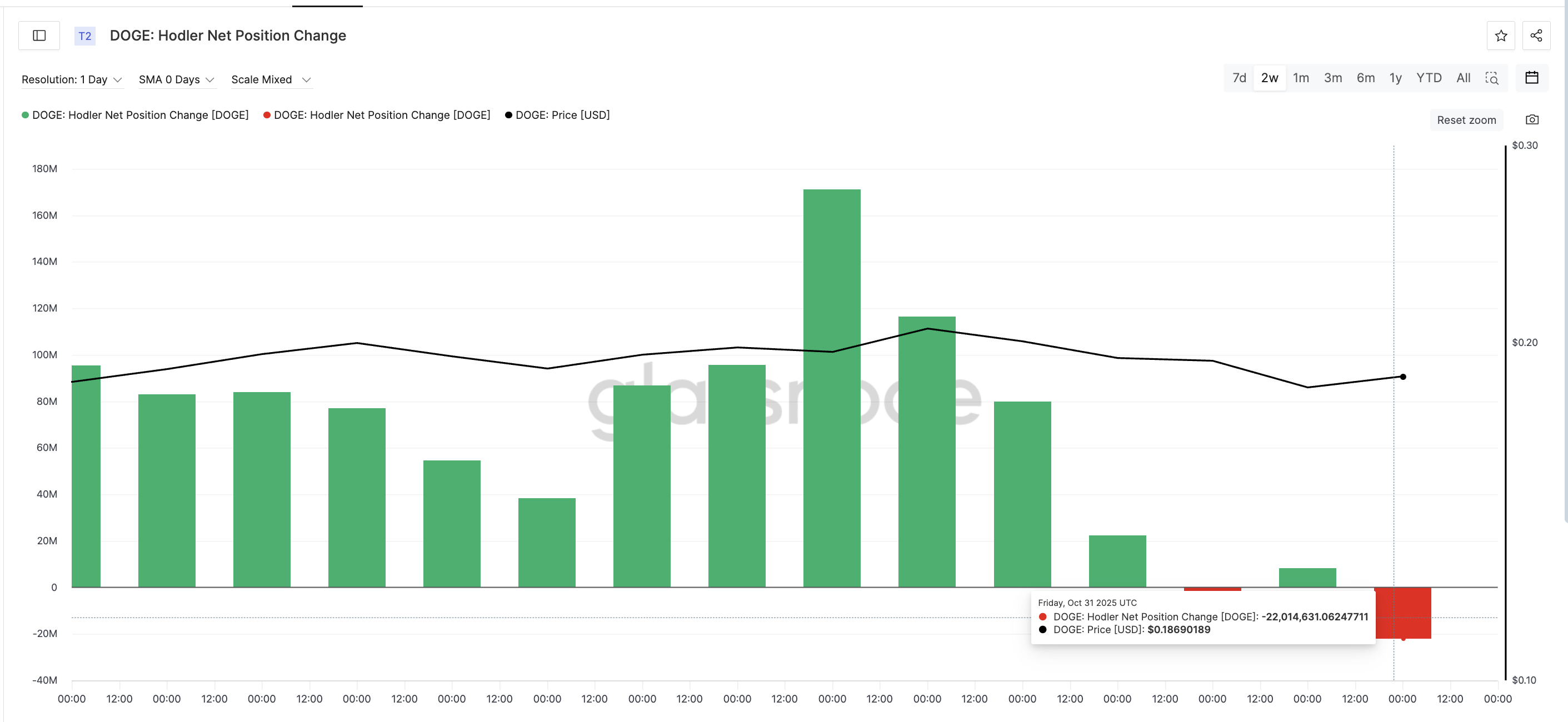

However, this protective buffer is rapidly deteriorating. Data from Glassnode indicates a sharp shift in the Hodler Net Position Change—tracking the activity of long-term wallets—flipping to a negative trend on October 31. This metric saw a dramatic drop from an inflow of +8.2 million DOGE to an outflow of -22 million DOGE in just 24 hours, representing a staggering 367% reversal in holder sentiment.

This trend suggests that even long-term holders are beginning to sell off their assets. If this behavior persists, it could erode the $0.177-$0.179 support cluster, leaving Dogecoin's most robust support level since early October vulnerable to further declines.

Should the price drop below $0.17, the next significant support level does not appear until $0.14, creating a substantial gap that could lead to further losses. More on this in the subsequent section.

Potential Death Cross Could Intensify Price Decline

As the situation unfolds, traders are also wary of a looming death cross, a technical indicator that occurs when a short-term moving average crosses below a long-term moving average. This signal is often viewed as a bearish indicator, and should it materialize, it may accelerate the downward momentum for DOGE.

The market remains on edge as long-term holders continue to exit, and the viability of Dogecoin's recent support levels is now in question. The coming days will be crucial in determining whether the $0.17 floor can withstand the pressure or if a deeper decline is imminent.

In summary, Dogecoin's resilience is being tested as long-term holders liquidate their positions, and the indicators suggest a challenging road ahead for the popular altcoin.

Tags:

Related Posts

5 Simple Steps to Supercharge Your Remote Work Life

Struggling with remote work? Discover five practical steps that transformed my productivity and motivation while working from home. Let's elevate your game!

10 Tips to Enhance Communication in Remote Teams

Struggling with remote team communication? Here are 10 essential tips from a seasoned pro to help your virtual collaboration thrive.

Mastering Excel Formulas: A Beginner's Friendly Guide

Feeling lost in Excel? Join me on a journey to unlock the magic of formulas and turn that confusion into confidence—let's make data work for you!

Mastering SEO: 10 Essential Tips for Blog Writing in 2023

Feeling lost with SEO? Discover 10 practical tips to write SEO-friendly blog posts that engage and expand your audience in 2023!

Create Online Courses That Engage: Your 2023 Guide

Want to make your online courses more engaging? Discover tips to transform dull lessons into interactive experiences that your students will love!

Building Bridges: Your Guide to Accessible Websites

Discover how to make your website welcoming for everyone, regardless of their abilities. Let's create an inclusive online space together!