Economist Reveals Economic Disparity: Wealthy Thrive While Others Struggle

Diane Swonk highlights a growing economic divide: only high earners feel positive, while others face challenges amid rising inflation.

The Uneven Economic Landscape

While inflation may be showing signs of a slower increase than anticipated, the stock markets seem to be celebrating, and expectations are mounting for the Federal Reserve to implement cuts soon, Diane Swonk isn’t raising a toast.

The experienced economist asserts that the economy appears to be in better shape than it truly is, largely due to the degradation of the very metrics that assess it. As the fourth quarter approaches, she warns that the façade of stability may soon crumble.

“Currently, the only demographics expressing satisfaction with the economy are those earning over $200,000 and those holding substantial stock portfolios,” Swonk stated.

Inflation Trends and Consumer Price Index

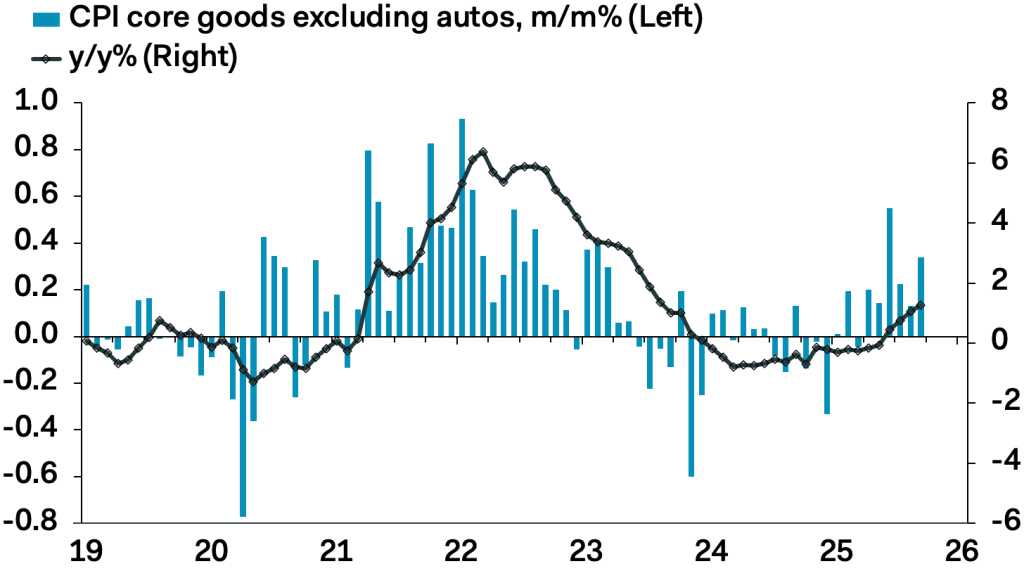

The consumer price index (CPI) for September reported a 0.3% rise month-over-month and a year-over-year increase of 3%. The core index, which the Fed closely monitors, showed a more modest increase of 0.2%. Economists had anticipated a slightly higher figure, forecasting a 0.4% rise in the overall CPI and a 0.3% increase in the core index.

Although the results fell short of expectations, inflation is still on an upward trajectory annually, with September's rate up from 2.9% in August. Currently, the CPI sits at its highest point since January. During the spring, inflation had been steadily decreasing—reaching just 2.9% in both May and June—before climbing once again due to rising energy prices.

Energy costs are once again a significant factor, with gasoline prices climbing by 4.1%, while food prices have stabilized, and core inflation—excluding food and energy—has slowed to 0.2%. The markets responded positively, interpreting the data as a sign that inflation is under control, which has led to increased speculation regarding a potential quarter-point rate cut by the Fed during the upcoming FOMC meeting next week and again in December.

However, Swonk, who serves as the chief economist at KPMG, perceives a deeper issue: a gradual yet troubling dilemma that is both statistical and structural, compounded by rising psychological factors.

“It’s more of a creeping problem than a sudden spike,” she explains, emphasizing that the overall figure obscures persistent “stickiness” in prices within the service sector and highlights an expanding divide regarding who is actually experiencing relief.

The Illusion of Economic Stability

Swonk highlights that many categories keeping inflation in check are either shielded from tariffs or benefiting from temporary exemptions, such as computers, smartphones, and certain vehicle imports. She cautions that as these factors diminish, “goods prices will continue to rise,” with minimal indications of widespread disinflation. She estimates that core services, excluding shelter—an important metric for the Fed—rose by approximately 0.4% in September, remaining more than 3% higher than a year ago, which is “well above any figures we witnessed prior to the pandemic.”

This persistent inflation, she warns, is exacerbated by a divided consumer base, which some economists refer to as the “K-shaped economy.” Wealthier households are continuing to spend freely on travel, entertainment, and luxury goods, driving service-sector inflation higher. In stark contrast, lower- and middle-income consumers are feeling the pinch, opting to downgrade their purchases, stretch their budgets thinner, or postpone buying altogether.

“Retailers are acutely aware of this disparity,” Swonk remarked, describing the challenges they face in catering to such contrasting consumer behaviors.

As we navigate through these complex economic waters, it’s clear that while some may find themselves thriving, many others are grappling with the harsh realities of a divided economy.

Tags:

Related Posts

Unlock Growth: 13 Game-Changing Strategies for Startups

Ready to supercharge your bootstrapped startup? Discover 13 powerful customer acquisition strategies that won't break the bank. Let's grow together!

From Freelancer to Agency Leader: Your Roadmap to Success

Thinking about turning your freelance gig into a thriving agency? This guide is your go-to resource for making that exciting transition happen!

Turn Your Idea into an MVP in 30 Days—No Coding Needed!

Feeling stuck with your big idea? Discover how to build your MVP in just 30 days using no-code tools and make your vision a reality!

Unlocking Startup Success with the Business Model Canvas

Feeling uncertain about your startup idea? Discover how the Business Model Canvas can help you validate your concept and boost your confidence.

Validate Your Startup Idea with the Business Model Canvas

Struggling to decide if your startup idea is worth pursuing? Discover how the Business Model Canvas can bring clarity and direction to your vision!

Start Your Consulting Business on a Shoestring Budget

Ready to turn your expertise into a consulting business without spending a dime? Discover practical tips to launch successfully and thrive!