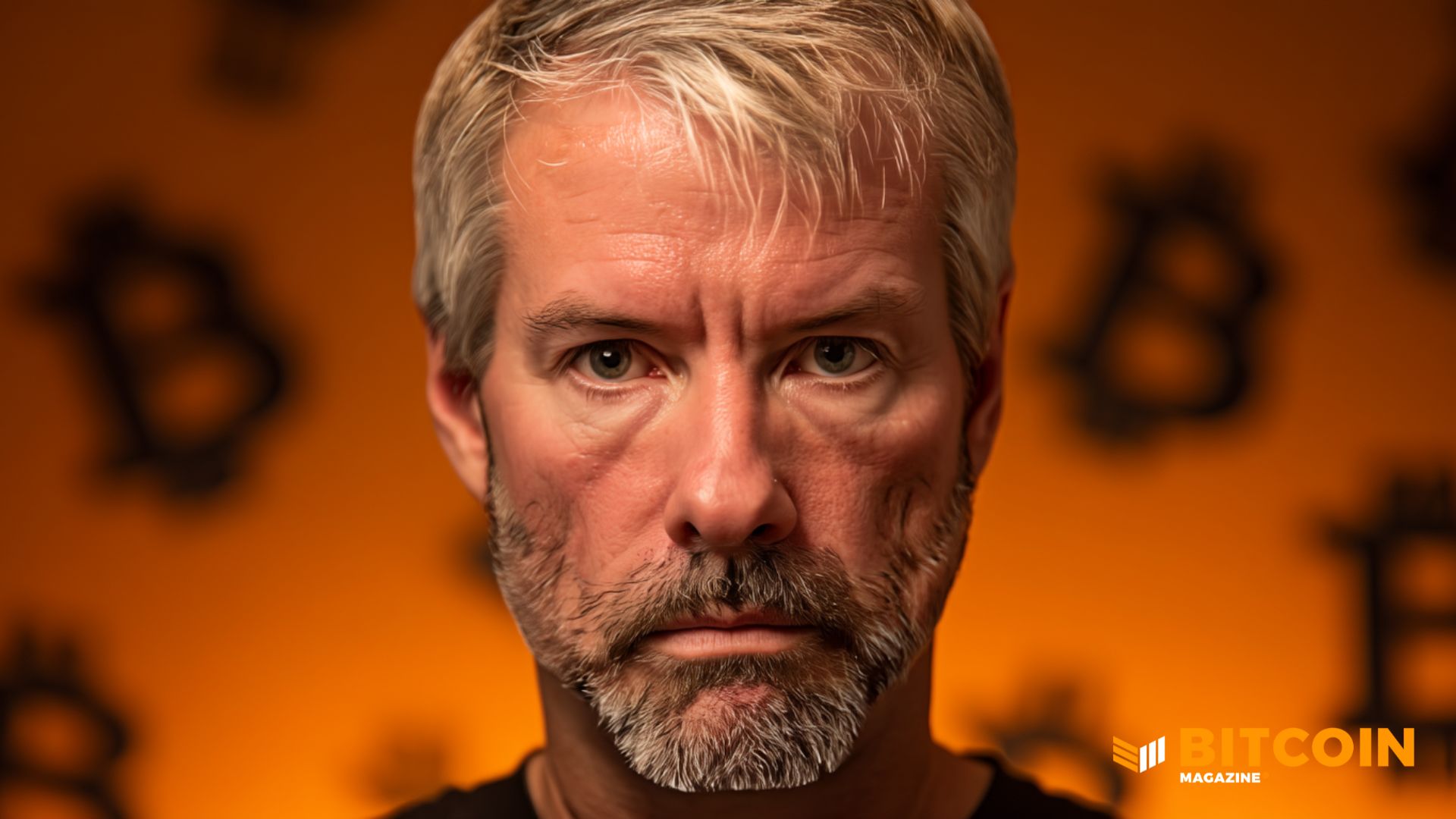

Michael Saylor Stands Firm on Bitcoin Amid Index Fears

Michael Saylor, CEO of Strategy (MSTR), reassures investors that their commitment to Bitcoin remains strong, despite concerns over index exclusions.

Bitcoin Magazine

Michael Saylor Stands Firm on Bitcoin Amid Index Fears

Michael Saylor, the CEO of Strategy (MSTR), has responded to recent warnings suggesting that the company could experience massive passive outflows if MSCI decides to exclude it from prominent equity indices.

In a post on X, Saylor clarified that Strategy is "not a fund, not a trust, and not a holding company." He emphasized that the firm operates as a publicly traded company with a thriving $500 million software sector and a distinctive treasury strategy that leverages Bitcoin as a productive asset.

Saylor took the opportunity to showcase the company’s recent initiatives, which include five public offerings of digital credit securities—namely $STRK, $STRF, $STRD, $STRC, and $STRE—totaling over $7.7 billion in notional value.

Additionally, he highlighted Stretch ($STRC), a credit instrument backed by Bitcoin that provides variable monthly USD returns for both institutional and retail investors.

"Funds and trusts passively hold assets. Holding companies simply sit on investments. In contrast, we are engaged in creation, structuring, issuance, and operation," Saylor pointed out. "No passive investment vehicle or holding company can replicate what we are achieving."

He characterized Strategy as a pioneering enterprise: a Bitcoin-backed structured finance firm that is innovating in both capital markets and software.

Saylor reiterated that the company’s index classification does not dictate its identity. "Our strategy is long-term, our belief in Bitcoin remains steadfast, and our mission is unchanged: to establish the world’s first digital monetary institution grounded in sound money and financial innovation," he stated.

Is Strategy Facing Nasdaq 100 Exclusion?

This statement comes amid concerns raised by JPMorgan analysts, who warned that the potential exclusion of Strategy from major indices by MSCI could result in a staggering $2.8 billion in outflows, which could escalate to $8.8 billion if other index providers follow suit.

Currently, Strategy’s market capitalization stands at approximately $59 billion, with nearly $9 billion of that amount allocated to passive index-tracking vehicles. Analysts have indicated that any exclusion could trigger increased selling pressure, widen funding spreads, and diminish trading liquidity.

Strategy’s presence in indices like the Nasdaq 100, MSCI USA, and MSCI World has been instrumental in integrating Bitcoin investments into mainstream portfolios. However, MSCI is reportedly reviewing whether firms with significant digital-asset holdings should continue to be part of conventional equity benchmarks.

Many market players are beginning to view companies heavily invested in digital assets as akin to investment funds, which are typically ineligible for index inclusion.

Despite the recent volatility in Bitcoin and anxieties regarding potential outflows, Strategy remains committed to its long-term vision of establishing a Bitcoin-backed financial enterprise, with aspirations to develop new financial offerings and a digitally native monetary institution.

On October 10, Bitcoin and the broader cryptocurrency market experienced a significant downturn. While some speculate the decline was linked to Trump’s tariff threats against China, others are analyzing the ramifications of such geopolitical developments on the crypto space.

Tags:

Related Posts

Start Your DIY Hydroponic Garden: A Beginner’s Guide

Ever dreamed of growing fresh veggies indoors? Discover how to start your own DIY hydroponic garden and enjoy garden-fresh flavors right at home!

Remote Work Trends to Watch in 2024

Curious about what remote work will look like in 2024? Discover key trends and insights that will shape our work lives in the coming year!

5 Proven Tips to Boost Your Focus and Productivity at Work

Struggling to focus at work? Discover five research-backed techniques that can help you sharpen your concentration and elevate your productivity!

Kickstart Your Creativity: A Beginner's Guide to Illustrator

Ready to dive into digital art? Join me on a fun journey through Adobe Illustrator, where I'll help you unleash your creativity, step by step!

E-commerce in 2023: Trends Shaping Our Shopping Future

Curious about how shopping has changed since the pandemic? Discover the latest e-commerce trends and what they mean for your online experience in 2023!

10 Essential Tips for Better Remote Team Communication

Struggling with remote team communication? Discover 10 practical tips that can help your virtual team thrive and connect more effectively.