Understanding Bitcoin's Current Market Dynamics: A Closer Look

Bitcoin faces challenges as long-term holders sell off assets. A deeper look reveals the dynamics affecting its price amidst shifting demand.

Bitcoin Struggles to Maintain Momentum

The onset of November has not been kind to Bitcoin, as the leading cryptocurrency continues its volatile trajectory from October. On the afternoon of Friday, November 7, Bitcoin experienced a notable decline, dipping below the critical $100,000 threshold for the second time in just a week.

This recent downturn in Bitcoin's price can largely be linked to a notable shift in investor behavior, particularly among a group referred to as long-term holders (LTHs). A notable figure in the crypto community on X, Julio Moreno, has offered valuable insights regarding how LTH actions are influencing Bitcoin's market dynamics.

Shifting Trends in Bitcoin Demand

In his recent update on the X platform, CryptoQuant's Head of Research, Julio Moreno, pointed out that long-term holders of Bitcoin have been increasingly selling their assets in recent weeks. Moreno emphasized that this trend of LTHs divesting isn't entirely unprecedented.

Historically, it is not uncommon for Bitcoin’s long-term investors to reduce their holdings during bullish market phases, capitalizing on high prices to realize profits. However, what's notable this time is the absence of sufficient demand to absorb these sales.

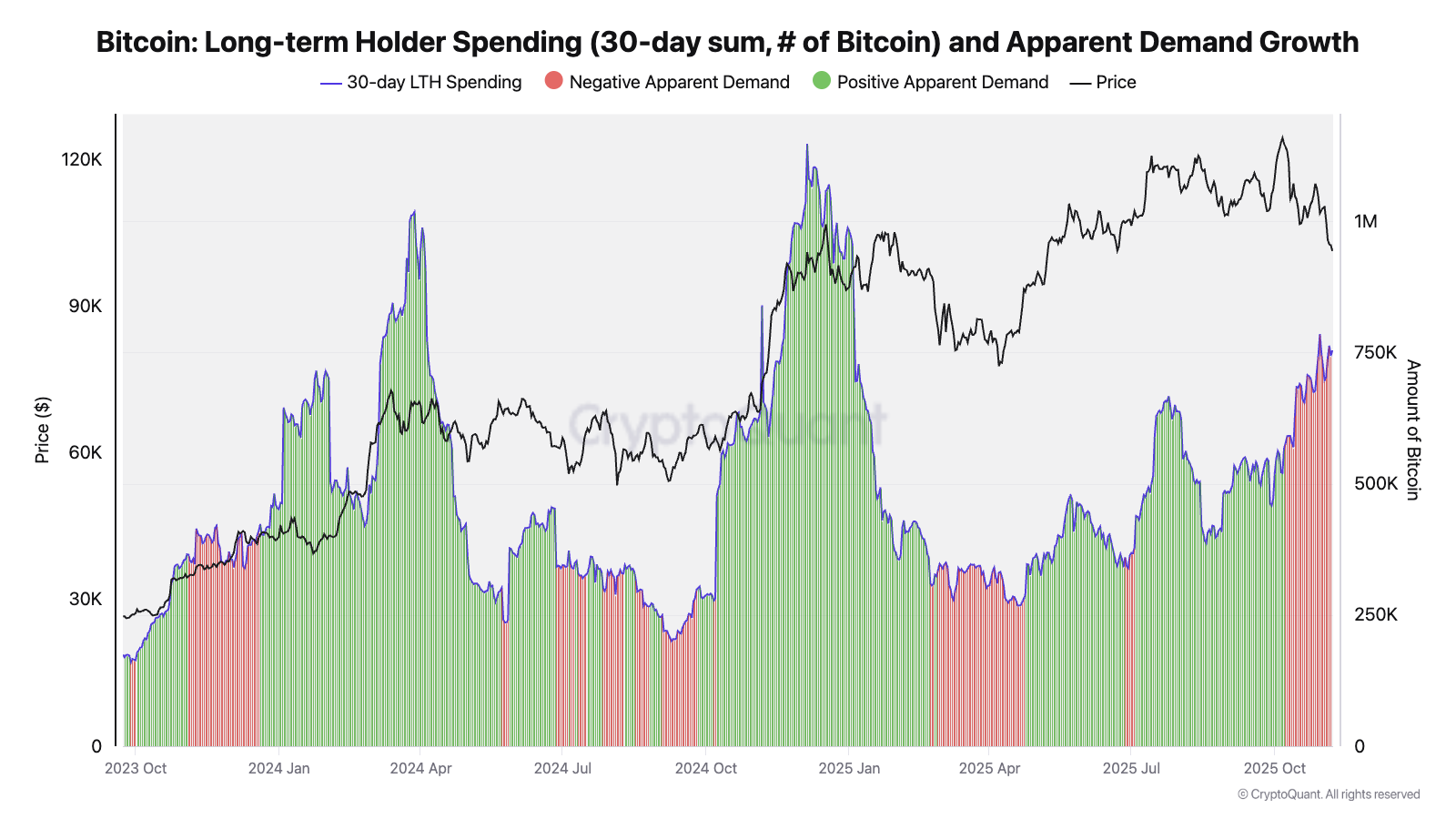

To illustrate his point, Moreno presented a chart that highlights the spending patterns of long-term holders alongside the apparent demand growth for Bitcoin over the past few years. Apparent demand growth is defined as the difference between the volume of Bitcoin being acquired and the amount that is being mined.

Moreno noted that previous all-time highs in Bitcoin's price coincided with periods of increased selling by long-term holders, but characterized by positive apparent demand growth. This pattern was clearly observable during the rallies that peaked in January-March 2024 and November-December 2024.

The chart underscores that while long-term holders have been offloading their Bitcoin since October, this behavior isn't particularly out of the ordinary. What is alarming, however, is the contracting apparent demand growth, indicating a lack of buying pressure to absorb the supply from LTHs at elevated price points.

Ultimately, these on-chain observations suggest that the current selling activities of Bitcoin’s long-term holders may not warrant excessive concern. For Bitcoin to regain its upward momentum in the weeks ahead, a rebound in apparent demand growth will be essential.

Current Bitcoin Price Overview

As of the latest updates, Bitcoin has managed to reclaim its position above the $100,000 mark, trading at approximately $103,700, reflecting a nearly 3% increase over the last 24 hours.

Tags:

Related Posts

5 Game-Changing Consumer Behavior Trends for 2024

Curious about what drives buyers in 2024? Discover five key trends shaping consumer behavior and how they can impact your strategies this year.

10 Time Management Tips Every Remote Worker Needs

Struggling with distractions at home? Discover 10 practical time management tips that can boost your productivity and help you thrive in remote work!

Reclaim Your Time: 10 Tips for Better Work-Life Balance

Feeling overwhelmed? Discover 10 practical tips to enhance your work-life balance today and reclaim your personal time for a happier life.

Take Control: Your Guide to Creating a Personal Budget

Feeling lost with your finances? Discover how to create a simple budget template that can change the way you manage money for good!

Unlocking Mindful Productivity: 5 Strategies for Remote Work

Struggling to stay focused while working from home? Discover five unique strategies that boost productivity and enhance your well-being in this engaging read.

Mastering 2023: Key Marketing Insights for Brands

Discover how to navigate the ever-changing marketing landscape in 2023 and elevate your brand with fresh insights and strategies.