XRP Price Forecast: Navigating Post-Swell Market Dynamics

XRP's recent price movements reflect the impact of ETF dynamics and impending technical indicators as traders weigh potential market shifts.

The cryptocurrency XRP saw a notable rebound of 4.59% on Friday, bringing its price to $2.3140. This surge can be attributed to growing momentum surrounding spot ETFs, as several issuers have submitted revised S-1 filings to circumvent delays caused by the ongoing government shutdown, which had previously impacted bullish XRP price forecasts.

Canary Capital has notably eliminated the language that caused delays, potentially gearing up for a launch on November 13.

Following suit, Bitwise, Franklin Templeton, and 21Shares are also rushing to secure a first-to-market advantage with their offerings.

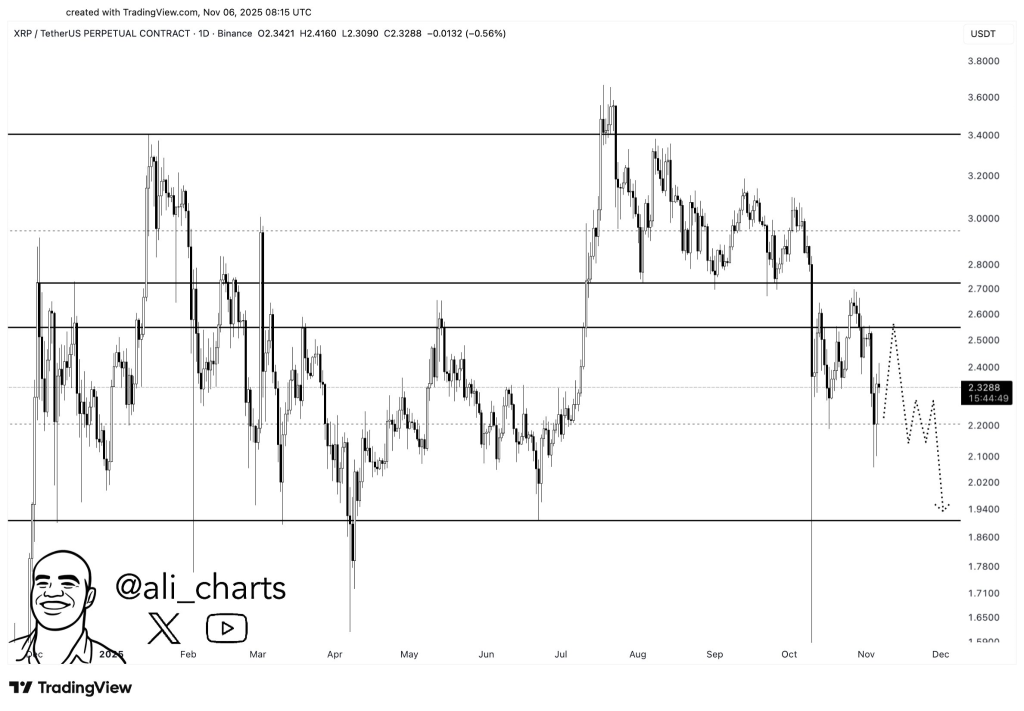

Despite the recent uptick, XRP is down 7.72% for November, following an 11.84% drop in October. The token currently sits below both the 50-day and 200-day exponential moving averages (EMAs), as traders remain vigilant for confirmation of a death cross. The volatility following the Swell event has resulted in a significant 36% correction from its previous highs of $3.60.

The SEC's Generic Listing Standards now allow for commodity-based ETF listings without the need for the traditional 19b-4 approval, which can often take as long as 240 days to process.

By removing the delaying language from their filings, issuers can potentially launch their ETFs after a mere 20 days, sidestepping the delays linked to the government shutdown, as the SEC is currently operating with minimal staff.

Canary Capital stands to gain a significant first-mover advantage, as other competitors are expected to launch shortly thereafter.

Get ready: Canary XRP ETF (XRPC) is coming soon. More info available in prospectus: https://t.co/y66AAqoGil pic.twitter.com/h8tewn25Jd

More info available in prospectus: https://t.co/y66AAqoGil pic.twitter.com/h8tewn25Jd

Meanwhile, companies like CoinShares, Grayscale, and WisdomTree are left waiting for the reopening of the market unless they also file amended S-1 forms.

Nate Geraci, President of NovaDius Wealth Management, remarked that these potential launches could serve as the "final nail in the coffin for previous anti-crypto regulators," emphasizing the transition from the SEC's legal struggle with Ripple to Paul Atkins' Project Crypto initiative.

XRP is currently testing support levels around $2.32, with bearish projections suggesting a potential drop to the $1.90-$2.00 range, indicating an additional downside of 14-17%.

The convergence of the 50-day and 200-day EMAs presents a concern for a death cross. Immediate support levels are identified between $2.60 and $2.70, while a more critical range lies between $2.00 and $2.55.

Tags:

Related Posts

Your Friendly Guide to Choosing a Secure Hardware Wallet

Feeling overwhelmed by hardware wallet choices? Let’s simplify it! Discover how to safeguard your crypto assets with the right storage solution.

Bouncing Back: 5 Steps to Recover from Crypto Losses

Lost money in crypto? You're not alone! Discover five practical steps to help you bounce back and regain your investing confidence.

How to Explain Cryptocurrency at Family Dinner

Not sure how to tackle the cryptocurrency convo with your family? This guide breaks it down in a way everyone can understand—without the jargon!

Exploring NFT Real Estate: A New Investment Frontier

Curious about how NFTs are changing real estate? Discover the potential of digital property investments and what it means for the future of ownership.

Start Earning Passive Income with Ethereum Staking

Learn how to make your Ethereum work for you! Discover the steps to start staking and turn your crypto into a reliable source of passive income.

Top 5 Yield Farming Platforms in 2023: My Personal Picks

Curious about yield farming? Join me as I break down the top 5 DeFi platforms for 2023—let’s find the best options together!