Saylor Stands Firm: MicroStrategy's Business Identity Under Fire

Michael Saylor asserts MicroStrategy's identity amid MSCI's review, emphasizing its operational nature over classifications as a fund or trust.

Saylor Stands Firm: MicroStrategy's Business Identity Under Fire

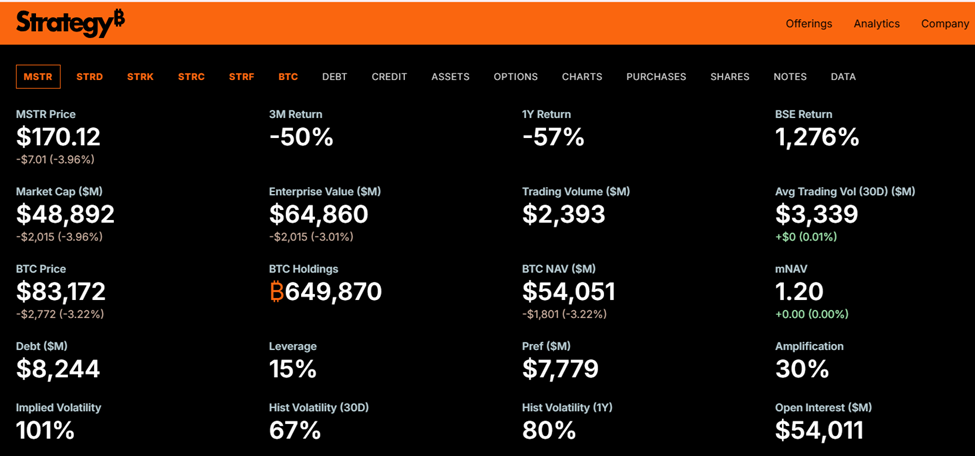

Michael Saylor, the CEO of MicroStrategy, has responded assertively to MSCI’s ongoing evaluation of the company’s classification, asserting that MicroStrategy operates as a hybrid business rather than an investment fund.

This clarification arises amid a formal consultation regarding the categorization of digital asset treasury firms (DATs) in major equity indices, a decision that holds significant implications for MicroStrategy's stock, MSTR.

Defining MicroStrategy: “We’re Neither a Fund Nor a Trust”

In a comprehensive post on X (formerly Twitter), Saylor made it abundantly clear that MicroStrategy does not fit the mold of a fund, trust, or holding company.

“We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that utilizes Bitcoin as productive capital,” he explained.

This assertion positions MicroStrategy as more than just a holder of Bitcoin, with Saylor highlighting the passive nature of traditional funds and trusts.

“Holding companies simply sit on investments. We actively create, structure, issue, and operate,” Saylor emphasized, underscoring the company’s dynamic involvement in the digital finance space.

In 2023 alone, MicroStrategy has executed five public offerings of digital credit securities, namely STRK, STRF, STRD, STRC, and STRE, collectively exceeding $7.7 billion in notional value.

Of particular interest is the Stretch (STRC) instrument, a Bitcoin-backed treasury product that provides variable monthly USD yields to both institutional and retail investors.

Saylor depicts MicroStrategy as a structured finance entity backed by Bitcoin, strategically positioned at the crossroads of capital markets and software innovation.

“No passive vehicle or holding company could achieve what we’re accomplishing,” he asserted, emphasizing that the classification of the company by indices does not dictate its operational identity.

The Significance of MSCI's Decision

MSCI’s consultation may lead to a potential reclassification of companies like MicroStrategy as investment funds, which would disqualify them from inclusion in vital indices such as MSCI USA and MSCI World.

The ramifications of such a reclassification could result in billions of dollars in passive investment outflows and could exacerbate the volatility surrounding MSTR, a stock that has already experienced a decline of approximately 70% from its peak value.

The implications extend beyond just MicroStrategy. Saylor reiterates that this issue affects the broader landscape of digital assets and their recognition within established financial frameworks. The outcome of MSCI's review could set a precedent that influences how digital asset firms are perceived and categorized in the future.

Tags:

Related Posts

Start Your DIY Hydroponic Garden: A Beginner’s Guide

Ever dreamed of growing fresh veggies indoors? Discover how to start your own DIY hydroponic garden and enjoy garden-fresh flavors right at home!

Remote Work Trends to Watch in 2024

Curious about what remote work will look like in 2024? Discover key trends and insights that will shape our work lives in the coming year!

5 Proven Tips to Boost Your Focus and Productivity at Work

Struggling to focus at work? Discover five research-backed techniques that can help you sharpen your concentration and elevate your productivity!

Kickstart Your Creativity: A Beginner's Guide to Illustrator

Ready to dive into digital art? Join me on a fun journey through Adobe Illustrator, where I'll help you unleash your creativity, step by step!

E-commerce in 2023: Trends Shaping Our Shopping Future

Curious about how shopping has changed since the pandemic? Discover the latest e-commerce trends and what they mean for your online experience in 2023!

10 Essential Tips for Better Remote Team Communication

Struggling with remote team communication? Discover 10 practical tips that can help your virtual team thrive and connect more effectively.